Monday, June 7, 2010

US Army-Libya Army try to advance relations

[caption id="" align="aligncenter" width="462" caption="TRIPOLI, Libya - Major General William B. Garrett, commanding general, U.S. Army Africa (front row, center), meets with key Libyan military leaders during a trip to Libya to discuss the emerging relationship between U.S. Army and Libyan land forces in early May 2010"] [/caption]

[/caption]

The US and Libyan armed forces of both countries are trying to establish new military ties after years of being enemies.

This is a continuation of Africa's new importance to the US. The US lifted the embargo that was in place while Libya was developing its Nuclear program uptill 2004.

US companies were the big winners in lifting of the sanctions. They won most of the new contract bids.

More data in us oil imports from Libya.

The US and Libyan armed forces of both countries are trying to establish new military ties after years of being enemies.

The U.S. Army Africa commanding general made a historic trip to Libya to discuss the emerging relationship between the U.S. Army and Libya's land forces in early May 2010.

Major General William B. Garrett III visited Tripoli, where he held talks with key Libyan military leaders. The visit indicates the U.S. Army's commitment toward building a cooperative relationship with Libya's land forces and increasing regional security.

Garrett's visit was coordinated through the U.S. Embassy Tripoli, and U.S. Ambassador Gene Cretz greeted Garrett at Mitiga International Airport.

"We are gradually opening a dialog that has not existed between our land forces in a long time," Garrett said. "Times have changed and relationships must change too."

The general's first stop was the headquarters of the North African Regional Capability (NARC) to meet Major General Ahmid Auwn, Libya's chief of staff for Army Mechanized Units and Executive Director of the NARC. The NARC is part of the African Standby Force, which consists of five regional brigade-size commands that can support the African Union during times of crisis. Libyan willingness to open a dialogue with the U.S. Army is in an important part of increasing regional cooperation.

"We will look to the NARC leadership to work together on future events that are mutually beneficial," Garrett said.

The general also toured the Libyan Bureau of Technical Cooperation and National Committees and the Libyan Military Staff College, where he met with the director, Major General Ahmid Mahmud Azwai. These visits emphasized the importance of material standardization, training and education in developing future leaders.

Garrett's visit follows a military cooperation committee meeting held in Tripoli in late-February, where delegations of Libyan and U.S. military officers discussed areas of common interest and planned future partnership events, said Major Philip Archer, U.S. Army Africa's North African Regional Desk Officer. "Proposed events include inviting Libyan officers to visit Army schools in the United States, holding discussion on border security, conducting medical exchanges and sharing helicopter procedures," Archer said.

One of U.S. Army Africa's goals is to help Libya and other members of the NARC build the brigade into a capable force that is interoperable with other regional standby forces and can be used for peace support operations.

"U.S. Army Africa's discussions in Tripoli are a positive step toward working together with Libya's military," Garrett said. "We now have a better understanding of each other's goals and can work together to achieve increased security, stability and peace in North Africa."

Garrett concluded his trip to Libya with a wreath laying ceremony at the tomb of fallen American sailors, who perished when their ship exploded in Tripoli harbor in 1804.

This is a continuation of Africa's new importance to the US. The US lifted the embargo that was in place while Libya was developing its Nuclear program uptill 2004.

Sept. 20, 2004 - President Bush revoked the United States trade embargo on Libya on Monday and took other steps aimed at eventually establishing normal relations with the government of Col. Muammar el-Qaddafi in return for its keeping a promise to give up nuclear, chemical and biological weapons.....

Among the steps taken by Mr. Bush were the removal of economic restrictions on aviation services, permitting direct flights between the United States and Libya; unfreezing $1.3 billion in assets; and providing what Mr. McClellan said would be "a level playing field for U.S. businesses in Libya" by allowing them to secure American economic benefits for foreign investment.....

With the lifting of most economic sanctions, the way is clear for American oil companies to try to secure contracts or to revive previous contracts for Libya's vast oil reserves.

US companies were the big winners in lifting of the sanctions. They won most of the new contract bids.

US oil companies have been awarded most of the contracts on offer at the first open licence auction in Libya.

More data in us oil imports from Libya.

Labels:

Defense,

Energy,

Libya,

Oil,

Security,

US in Africa,

US Military,

US Oil imports

Investments in Africa starting to pay off for Bric countries.

Buy low, sell high as they say. It seems the BRIC nations ( Brazil, Russia, India, China) have taken that advice to heart. There early investments in Africa are showing results.

Africa has garnered attention as the next hot spot for foreign investors—and it's not just the West that's looking to the continent. Despite the recession, direct investment by the BRICs has soared, and at a much faster pace than those of Europe and the U.S.

A look at foreign direct investment from 2007-08 (the latest year available):

Percentage increase in EU investment in Africa, to $27.3 billion

Percentage increase in Brazilian, Russian, and Indian investment in Africa, to $2.35 billion

Percentage increase in Chinese investment in Africa, to $5.5 billion

Percentage decrease in American investment in Africa, to $3.3 billion

Source: Overseas Development Institute

Labels:

Africa,

China,

Economic investment,

India,

Investments

Sunday, June 6, 2010

Friday, June 4, 2010

The West must approach Africa in a new light

French President Nicholas Sarkozy said it well this past week at the France-Africa summit when he said this about Africa in today's world: “Africa’s formidable demographics and its considerable resources make it the main reservoir for world economic growth in the decades to come.”

Chatham House has a new report that states the relationship between the West and Africa should be looked at in a new prism. Asian countries seemed to have caught the changing winds especially countries like China, Japan, India but many western countries have yet to fully adjust to the changing reality. Russia has a renewed interest, Brazil as well. France due to historical reasons will always have interest in Africa and the lastest summit hosted by French President seems try and a new course with Africa. Reuters has a similar take:

For the past ten years, fundamental change has been taking place across large parts of Africa. Growth rates and stability have increased. Political, regulatory and security reform have deepened. Increasing investment from China, but also Brazil, India, Turkey, South Korea, Argentina and other ambitious emerging powers has acted for the most part as an accelerant.

Even the global financial crisis has in some ways hastened this process, for while in the short and medium term it had a devastating impact on millions across Africa, it has also revealed the true ebb of power from East to West, and encouraged the new economic actors of the G20 to chase access to the 40 percent of the world’s mineral resources, and 1 billion consumers gathered in Africa. Almost as important is the 25 percent of UN General Assembly votes that are represented by the continent’s 53 countries.

Meanwhile, many Western countries seem trapped in a humanitarian conception of Africa.

Popular media coverage and policy judgement is overwhelmed with a perception that Africa is simply a problem continent with little strategic value, except as a space where largess is shown and good things done to make up in some small way for the messy reality of international diplomacy.

This is not only delusional and self indulgent, but damaging. For emerging power interest is showing that Africa is not a space distinct from the rest of the world. Many of their investments are valuable and welcome, but others are as exploitative and damaging as anything under colonialism.

Without a Western strategic and business engagement – bringing with it a focus on sustainability, regulation and transparency, the progress of the past 10 years is unlikely to be sustained. For the truth is that China’s development policy is first and foremost about China’s development, not Africa’s, and as yet the governments of many emerging powers are not focusing enough on ensuring their investments in Africa are sustainable, and therefore equitable.

African leaders have never faced so much choice, but they need to show more foresight as well, for it is only by combining the energy of the emerging East, with the regulation of the West, that Africa’s, and the world’s interests will be served. That needs Western strategic engagement, but more fundamentally it requires more effective leadership from within Africa itself. Post financial crisis, the opportunities for Africa and the world economy, but also the risks, have never been higher.

These are the main highlights of the report by Chatham House:

- African countries are playing a more strategic role in international affairs. Global players that understand this and develop greater diplomatic and trade relations with African states will be greatly advantaged.

- For many countries, particularly those that have framed their relations with Africa largely in humanitarian terms, this will require an uncomfortable shift in public and policy perceptions. Without this shift, many of Africa's traditional partners, especially in Europe and North America, will lose global influence and trade advantages to the emerging powers in Asia, Africa and South America.

- China's re-engagement is for the most part welcome, as is that of the increasing numbers of emerging powers such as Turkey, South Korea and Brazil that see Africa in terms of opportunities - as a place in which to invest, gain market share and win access to resources.

- Economic fortunes across Africa are now diverging, making it less meaningful to treat Africa as a single entity in international economic negotiations. Despite this, it is in the global interest that the African Union should be granted a permanent place at the G20. In turn, a more focused, sophisticated and strategic African leadership is needed.

Nothing to disagree with, as a matter of fact these are the points that we at Stratsis Incite have been emphasizing all along.

Will having the World in Africa increase investment?

Thoughtful article. You only have to look at the US airline carriers (delta and united) growth in routes this year direct to Africa. . To underscore this shift in thinking about the continent. As well as it’s historic underinvestment.

With the sporting world about to shift its attention to South Africa for the next month, it could be a good time for countries to reassess their relations with the continent as a whole.

Two reports this week, one from U.K.-based think tankChatham House and one from consultancy McKinsey & Co, do just that.

McKinsey’s forecasts says sub-Sahara Africa is well-positioned to become the developing world’s “next great success story” and an investment target for those seeking new markets. [Read the report here.]

Meanwhile, Chatham House said that many Western nations are still weighed down by perceptions of Africa as an aid recipient rather than a strategic trading partner and risk missing opportunities that China and Brazil are already tapping into. [Read the report here.]

Why does it matter?

As Chatham House points out, Africa accounts for 40% of the world’s basic mineral resources, 10% of freshwater supplies and 15% of agriculture land. It’s also about to become a larger player in the world’s oil production.

The rise in prices for minerals such as gold and copper since 2000 has helped lift the continent’s GDP. McKinsey says its collective GDP as of 2008 was $1.6 trillion, roughly equal to that of Brazil’s or Russia’s, and that real GDP growth rose by 4.9% between 2000 and 2008, more than twice its pace of the 1980s and 1990s.

While the financial crisis in the past two years seriously cut African trade and reduced foreign investment, it’s picking up again.

In the iron ore sector alone — important as iron ore is used to make steel — some of the world’s biggest mining groups have struck important investment deals in West Africa this year.

Developing nations have latched onto Africa’s economic potential and have increased their share in Africa’s total exports and imports in 2009, Standard Chartered research shows — emerging economies increased their share of Africa’s total exports in 2009 to 40% from 33% in 2008 and for imports to 47% from 46%.

Chatham House compiled data for export and import values between different countries and the African continent, showing export values to Africa grew between 2006 and 2008 by about 50% for the U.S. to $29 billion and 87% for China to $50 billion.

Africa is also becoming a good destination for goods — Africa is urbanizing and has as many cities with populations of at least one million, just as Europe does, McKinsey says.

There are risks to growth and investment, however. The individual countries in Africa face serious challenges such as poverty and disease. Political uncertainty and corruption are also still strong in many countries.

“Wars, natural disasters or poor government policies could halt or even reverse these gains in any individual country,” research from McKinsey Global Institute said. “But in the long term, internal and external trends indicate that Africa’s economic prospects are strong.”

Recent posts on the World Cup here and here.

Thursday, June 3, 2010

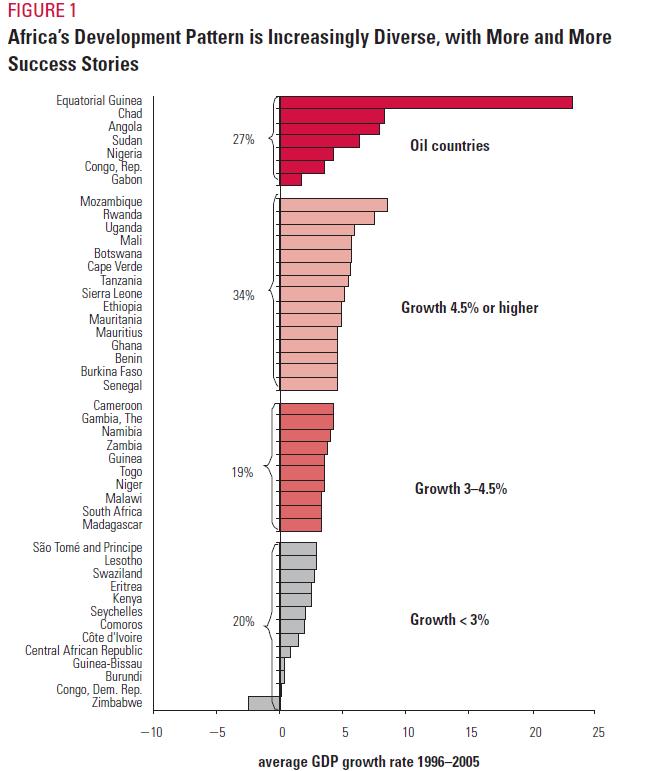

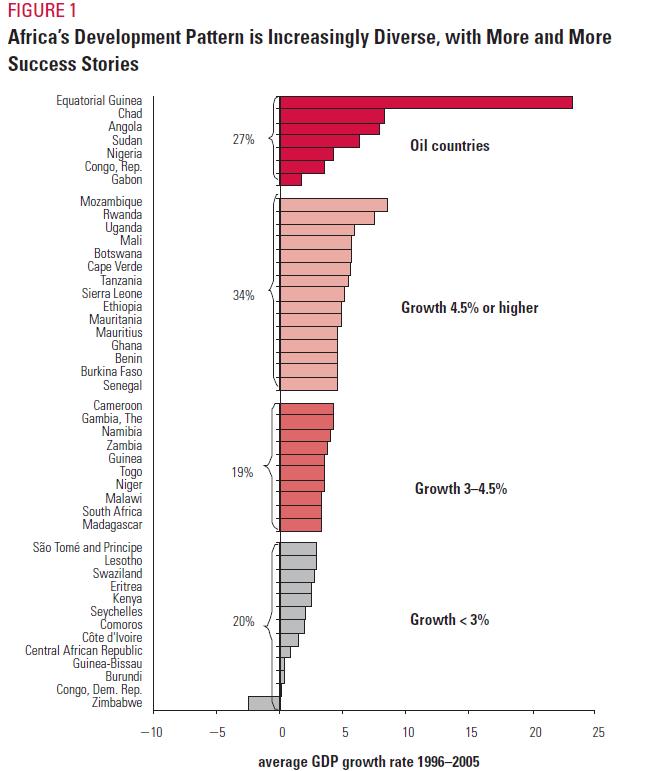

Graph of the day

Engrossing graph encountered while researching the effect of Chinese investment in Africa (click on it for the full size version):

From the excellent World Bank report, Africa’s Silk Road.

From the excellent World Bank report, Africa’s Silk Road.

Labels:

Africa,

Economic investment,

Economics,

Investment

American Peace keepers in the Congo?

Analyst Michael O’Hanlon’s proposes that the U.S. send forces to Democratic Republic of Congo to kick-start a new peacekeeping organization that might help rescue the country from scores of overlapping conflicts. The existing U.N. force just isn’t working — and the DRC government wants those peacekeepers to leave.

The UN has had peacekeepers in the Democratic Republic of Congo for a decade. Congolese President Joseph Kabila, hoping to show he’s not reliant on the blue helmets, wants the force to go in 2011. Almost every outside analyst thinks that this could precipitate a disaster, with militias running rampant, the hopeless Congolese army unable to cope and the country’s neighbors moving in to gobble up territory.

The UN hopes that it will be able to keep at least some troops – maybe about 6,000, compared to the current 20,000 – to protect civilians in the especially vulnerable eastern Congo. This would do some good, but how much? The peacekeepers were thoroughly outmaneuvered by militias in the east in 2008, and I’m not sure that a reduced presence could do more than stifle low-level violence. What is to be done?

O’Hanlon had pleaded his case in an interview for World Politics Review column last week:

Ideally, we’d see an entire American brigade, but that’s not realistic. Barring that, how about a battalion doing a mission along the lines of Special Forces, doing intelligence-gathering and planning? … That would enable a country like France, which is not as globally committed but is afraid to stick its neck out [to deploy troops]. We need more Western forces.

I’m afraid that’s not going to happen, although I applaud O’Hanlon’s advocating an idealistic but unpopular line.

France is trying to cut back its presence in Africa, and there are huge obstacles to it playing a role in the Great Lakes region — the locals haven’t forgotten the questionable French part in the Rwandan genocide.

But I think that there may be a broader fallacy here: the idea that getting new combat forces into the Congo is what’s needed in the first place. Yes, the U.N. has struggled with 20,000 troops — but as I think O’Hanlon himself once noted, you might need up to 200,000 to stabilize somewhere on the scale of Congo. Rather than focus on numbers, I’d try to see if there are any light-weight ways the U.S. can affect the political decision-making of [DRC President] Kabila and his neighbors (especially the hawkish Rwandans).

Here’s one possible formula. While the U.N. should maintain the 6,000 troops on active protection duties, the U.S. should deploy around 100 military observers to operate in the U.N. framework. Why? The U.N. already has a bunch of observers in Congo, and the U.S. is said to have spooks and special forces in the east. But American colonels and captains publicly monitoring the situation would send a clear message to the Congolese and their neighbors that Washington wants calm. This American mini-presence would also play a tripwire role: it’s one thing to outflank and embarrass standard U.N. infantry, but quite another to play games in front of U.S. observers.

What makes this option half-credible is that the Obama administration has already thought about sending more military staff officers on UN missions – the President said so himself last year – so this idea is not too far from current policy. That said, the U.S. has just 10 military experts in UN operations at present (the figures are here). 2 of them are in the Congo. The Pentagon is rumored to be unenthusiastic about helping the UN – but 100 personnel is not beyond the realms of the possible. They don’t need to be O’Hanlon’s green berets… though that would be nice.

I don’t think that 100 Europeans would have the same effect. China, which has invested a lot in the Congo, could send more observers or regular troops and reinforce the American message. I can see this proposal running into lots of quibbles, but it might be just the low-cost, high-profile help the UN needs in Congo now.

The U.S. Congress has also recently passed a law requiring the U.S. military to craft a strategy for defeating one of Congo’s most dangerous rebel groups.

Wednesday, June 2, 2010

World Cup and Economics

Goldman Sachs may have taken a lot of heat lately, but they may have done themselves a great favor by releasing their 2010 World Cup Research Report earlier this month. Running a little over 70 pages, it's a remarkably in-depth summary of each country in this year's finals, including football prowess, economic state, and political situation. Furthermore, it provides a primer on the potential hosts of the 2018 and 2022 World Cups, and, unsurprisingly but more than interesting, an examination of economic growth and decline vis-a-vis the international football teams of respective countries.

Some of the most noteworthy things to take away: like most of the speculation has focused on, the report predicts a European-hosted cup in 2018, and a return to the U.S. in 2022. (Also included are bid pitches from Russia, England, and the U.S.) Interestingly, this is what it says about the U.S. bid:

The sport has taken roots in the USA and the market is quickly becoming one of FIFA’s most important. They already pay one of the largest television rights fees to FIFA of any country. However, the perception is still otherwise.

For U.S. soccer fans, that perception is extremely frustrating. It is somewhat accurate: for a team that has qualified for the last six World Cups (granted, a Foreign Policy* staff team could probably qualify for the finals out of the Confederation of North, Central American, and Caribbean Association Football -- CONCACAF), interest would appear to be lower than warranted. (Six out of six is, by the way, quite impressive: England, France, and the Netherlands can't claim that streak.)

But that's changing. Go to many bars in the District on Saturday or Sunday morning, and you'll see European football -- usually the English Premier League -- on the TV. From my own observations (be wary of perception bias), the sport with the most jerseys worn on the streets of Northern Virginia and D.C. is soccer, by far. Moreover, 24.5 million Americans play football, the second most (behind China's 26.2 million) in the world. Since 1994, there has been a dramatic increase in the number of U.S. soccer fans, but among casual or non-fans, there still remains an idea that soccer is not an "American" sport. (It should also be noted that the U.S. Women's team is the dominant global powerhouse.)

UEFA's (Union of European Football Associations) selection of the 2012 Euro Cup host proved prescient, as well. Picking in 2007, Poland won the rights to host the tournament (OK, co-host with Ukraine, but since then UEFA has suggested Poland be the sole host, which the Poles have graciously declined to accept). Poland, however, was the only bid country that hasn't suffered economic decline since -- and yes, Greece was the first bid country eliminated.

Other notable findings: the Growth Environment Scores (a Goldman-devised figure of sustainable economic growth and productivity) of respective countries loosely correlate to soccer performance, but a much stronger connection exists between the improvement of economic conditions and national soccer teams. (Algeria, which did not qualify for the 2006 finals in Germany, posted the highest GES improvement among developing countries over the last four years.) The report also argues that success is partially dependent on the number of males aged 18-34 in countries, and provides a UN chart with predictions for 2050. If the claim is accurate, the Nigerian Super Eagles are going to be really, really good in a few decades.

Lastly, Goldman offers their own predictions of the semi-finals (I won't spoil, though I will say it's what my predictions are as well), and lists the probability (with their metrics) that each country will become World Cup champions.

It's lengthy, but an extremely interesting read, and provides the best rundown of the Cup to come that I've seen. Check it out.

Tuesday, June 1, 2010

African nations seek reform in major world institutions.

[caption id="" align="aligncenter" width="411" caption="French President Nicolas Sarkozy spoke at a press conference with his South African counterpart Jacob Zuma."] [/caption]

[/caption]

African nations voiced a need for change in world major institutions like the World Bank, United Nations, & International Monutary Fund.

More background on previous post about the France-Africa summit.

[/caption]

[/caption]African nations voiced a need for change in world major institutions like the World Bank, United Nations, & International Monutary Fund.

More than 50 African countries and France called on Tuesday for an urgent reform of the United Nations Security Council and other institutions so the continent can better be represented in global governance.At the close of the 25th Africa-France summit, France announced plans to ensure African nations are better represented at the G-20 when France takes its turn at the helm of the group.

France and the 39 heads of state and government and 12 other national delegations which met for two days in the Riviera city of Nice called for African states to be fully integrated into the global economy.

The summit reviewed issues from peace and security to climate change but added a new dimension by inviting more than 200 business leaders to encourage development through free enterprise. A charter for good business was adopted to encourage transparency among French businesses operating in Africa and, it is hoped, serve as a model for companies from elsewhere.

France agreed to support the African Union in strengthening security on the continent, including the African Standby Force, and pledged ¤300 million ($369.1 million) for 2010 to 2012 and agreed to train 12,000 African troops for peacekeeping by the African Union and U.N.

French President Nicolas Sarkozy stressed that France, once a colonial ruler on the African continent, wants to strengthen its role on all parts of the continent where countries that are traditional outsiders, notably China, are profiting from multibillion dollar projects.

"France doesn't just want to be friends with francophone countries ... What we want is for France to talk to all of Africa," Mr. Sarkozy said at the closing session. The French president did away with the traditional "dinner among friends" featured at Africa-France summits in which only leaders of former colonies are invited. He held a dinner for all attendees Monday night.

"You are all friends, all of you, and we can build together," he said.

France has been pressing for a greater voice for Africa in critical international forums, such as the G-20 and the Security Council, where there are five permanent members with veto rights—and where Africa, which makes up some 25% of U.N. members, wants a voice.

South African President Jacob Zuma called the summit "very useful."

"We believe strongly that times have changed," he said. Climate change was a major issue at the summit, and the leaders linked it to development.

They agreed to support creation of a renewable energy plan for a sustainable electricity system "based on concrete projects and innovative financing." Among such projects would be use of solar power.

France announced creation of the African Agriculture Fund, an investors' fund, for food distribution and other projects, to initially raise $120 million and that could reach $300 million, according to a final statement.

The next summit is to be held in 2013 in Egypt, where the just-ended meeting was initially meant to be held. Because of concern that Sudanese President Omar al-Bashir, sought by the International Criminal Court for allegedly masterminding atrocities in Darfur, would be invited, France persuaded Cairo to allow the gathering to convene in Nice.

Zimbabwe's President Robert Mugabe, facing EU sanctions travel restrictions, also wasn't invited. The nation of Madagascar, the Indian Ocean island where a 2009 coup toppled an elected president, was excluded from the summit.

More background on previous post about the France-Africa summit.

Labels:

Africa,

Africa in the world,

Defense,

Economics,

France,

Global institutions,

Security

Sarkozy seeks fresh start and better trade at Africa summit

[caption id="" align="aligncenter" width="262" caption="French President Nicolas Sarkozy greeted Rwanda's President Paul Kagame."] [/caption]

[/caption]

This happens in the context of China's increase and economic-political expansion in Africa. Trade between Africa and China has increased 10 fold since 2000.

France is seeking to renew its ties with Africa at the two-day gathering that will touch on global governance and Africa's campaign for more of say at the United Nations Security Council, the UN's top decision-making body. France wants to increase the number of African states represented and also have two permanent African nations on the UN security counsel, but not let them have no veto power. Of course the lack of veto power was not welcomed by African delegates.

The summit is viewed by many as an attempt by the Elysee Palace to boost its dwindling influence in the region in the face of stiff competition from China, India and other emerging economic superpowers. China is now Africa’s biggest trading partner, and has invested billions over the past decade to tap into the continent’s raw materials to fuel its own fast-growing economy.

When he took office in 2007, French President Nicolas Sarkzoy vowed to break with the past and end what he described as the paternalistic relationship between France and its former colonies, a relationship based on privileges and hand-outs popularly referred to as “Francafrique”.

France has been frequently criticized for ignoring human rights violations in its former African colonies and propping up autocratic leaders in its quest for business privileges in the resource-rich continent.

In recent months, Sarkozy has attempted to mend France’s tense relations with Rwanda following the 1994 genocide. During a landmark trip to Kigali in March, Sarkozy said France would do everything possible to ensure that "all those responsible for the genocide are found and punished." Diplomatic relations between France and Rwanda were restored last year, three years after Kigali severed ties with Paris.

Has France really turned over a new leaf in Africa?

But critics say that 50 years after several African nations gained independence from France, not much has changed in the country's relationship with its former colonies.

While Sarkozy impressed when Liberian President Ellen Johnson Sirleaf became the first African head of state to be invited to the presidential palace after he took office, he disappointed many when his first visit to the continent was to Gabon: then-President Omar Bongo of Gabon was a central figure in the ‘old’ ‘Françafrique’ style of diplomacy.

The disappointment turned to outrage last year, when the French government appeared to support Bongo’s son, Ali Bongo, in the August 2009 polls, sparking criticism among Gabonese opposition figures and igniting street protests across Paris.

Sarkozy’s cozy relations with Paul Biya, whose 28-year rule in Cameroon has been criticised by international rights groups, has also raised eyebrows in Africa circles. Last year, when Sarkozy welcomed the controversial African leader by praising Cameroon for its moderation, demonstrators in Paris sported placards that read, "Biya murderer, Sarkozy accomplice."

At this year's summit however, Sarkozy aims to focus on business. To mark the start of the much-trumpeted new era in French-African relations, a charter is set to be signed at the end of the conference which will pledge greater cooperation in training, jobs and environmental issues.

And while the annual summit has traditionally focused on former French colonies, the only two heads of state to hold face-to-face talks with Sarkozy at the conference's sidelines are South Africa's Jacob Zuma and Nigeria’s Goodluck Jonathan, both leaders of former British colonies

[/caption]

[/caption]Over 250 African and French business leaders rubbed shoulders with African heads-of-state in Nice on Monday, as the 25th France-Africa summit, which for the first time will focus on both trade and politics, got under way.

NICE, France—Africa has the potential for exponential economic growth and must have a louder voice in world politics, President Nicolas Sarkozy said Monday, opening a summit with 38 African leaders.

Paris wants to use the gathering as a springboard for business deals and to bury bitter memories of colonial rule.

It is "completely abnormal" that no African country has a permanent seat on the United Nations Security Council, Mr. Sarkozy said, calling for reform of the body in an address to the Africa-France summit in the Riviera city of Nice.

"It is not possible to talk about the great questions of the world without the presence of Africa," Mr. Sarkozy said. "Our destinies are indissolubly linked." He said "Africa is our future" and will be a principle reservoir for world economic growth in the decades to come.

The 25th Africa-France summit coincides with the 50th anniversary of independence for 14 former French colonies. It marks a new era of ties—for Mr. Sarkozy a partnership of friends able to discuss commerce or stickier questions like human rights.

Breaking away from tradition, France has invited nearly 200 business leaders from France and Africa to this year's summit.

The dictatorships, conflicts, corruption and poverty that have plagued African nations for decades and define their image in the West have been reduced to sideline events at the two-day summit.

Egyptian President Hosni Mubarak stressed the need to change "African realities" through commerce and new infrastructure. He asked that the summit put the accent on developing African economies, including strengthening the role of the private sector.

"We want at all cost to end the marginal status of the African continent," he said.

A harsh reality for nations like France is the growing presence in Africa of China, India, Brazil and Iran, and to a lesser degree the U.S. Many of those nations are moving full speed ahead to scoop up Africa's natural resources, make trade and win contracts to build infrastructure.

In French-speaking countries, mainly in north and west Africa, France must live down its past as a colonial ruler. An Elysee Palace official said Mr. Sarkozy is more interested in bilateral talks with leaders of countries not in the circle of former colonies.

Only one African country wasn't invited to the summit—Madagascar, the Indian Ocean island where a 2009 coup toppled an elected president.

Notable absent leaders include Sudanese President Omar al-Bashir, sought by the International Criminal Court for allegedly masterminding atrocities in Darfur. Zimbabwean President Robert Mugabe, facing EU sanctions travel restrictions, also wasn't invited.

This happens in the context of China's increase and economic-political expansion in Africa. Trade between Africa and China has increased 10 fold since 2000.

France is seeking to renew its ties with Africa at the two-day gathering that will touch on global governance and Africa's campaign for more of say at the United Nations Security Council, the UN's top decision-making body. France wants to increase the number of African states represented and also have two permanent African nations on the UN security counsel, but not let them have no veto power. Of course the lack of veto power was not welcomed by African delegates.

The summit is viewed by many as an attempt by the Elysee Palace to boost its dwindling influence in the region in the face of stiff competition from China, India and other emerging economic superpowers. China is now Africa’s biggest trading partner, and has invested billions over the past decade to tap into the continent’s raw materials to fuel its own fast-growing economy.

When he took office in 2007, French President Nicolas Sarkzoy vowed to break with the past and end what he described as the paternalistic relationship between France and its former colonies, a relationship based on privileges and hand-outs popularly referred to as “Francafrique”.

France has been frequently criticized for ignoring human rights violations in its former African colonies and propping up autocratic leaders in its quest for business privileges in the resource-rich continent.

In recent months, Sarkozy has attempted to mend France’s tense relations with Rwanda following the 1994 genocide. During a landmark trip to Kigali in March, Sarkozy said France would do everything possible to ensure that "all those responsible for the genocide are found and punished." Diplomatic relations between France and Rwanda were restored last year, three years after Kigali severed ties with Paris.

Has France really turned over a new leaf in Africa?

But critics say that 50 years after several African nations gained independence from France, not much has changed in the country's relationship with its former colonies.

While Sarkozy impressed when Liberian President Ellen Johnson Sirleaf became the first African head of state to be invited to the presidential palace after he took office, he disappointed many when his first visit to the continent was to Gabon: then-President Omar Bongo of Gabon was a central figure in the ‘old’ ‘Françafrique’ style of diplomacy.

The disappointment turned to outrage last year, when the French government appeared to support Bongo’s son, Ali Bongo, in the August 2009 polls, sparking criticism among Gabonese opposition figures and igniting street protests across Paris.

Sarkozy’s cozy relations with Paul Biya, whose 28-year rule in Cameroon has been criticised by international rights groups, has also raised eyebrows in Africa circles. Last year, when Sarkozy welcomed the controversial African leader by praising Cameroon for its moderation, demonstrators in Paris sported placards that read, "Biya murderer, Sarkozy accomplice."

At this year's summit however, Sarkozy aims to focus on business. To mark the start of the much-trumpeted new era in French-African relations, a charter is set to be signed at the end of the conference which will pledge greater cooperation in training, jobs and environmental issues.

And while the annual summit has traditionally focused on former French colonies, the only two heads of state to hold face-to-face talks with Sarkozy at the conference's sidelines are South Africa's Jacob Zuma and Nigeria’s Goodluck Jonathan, both leaders of former British colonies

Labels:

Energy,

Energy competition,

Energy Resources,

France,

France in Africa,

Resources

African Economy to Grow 4.5% in 2010, World Cup to help export growth in South Africa.

The African continent will have robust economic growth this year.

The economic benefits of hosting a large scale international festival like a World Cup is paying off for South Africa.

This comes after news showing that African economies have passed the "stress test".

Lat years economic crisis was an opportunity to pass through reform measures and stay on the economic development front tempted to change course that many countries were on. Africa should stay on course, its going in the right direction.

ABIDJAN, Ivory Coast—Economic growth in Africa will rebound with growth of 4.5% in 2010 and 5.2% in 2011, according to forecasts in a report published Monday.

The African Economic Outlook 2010 report predicts the recovery will remain uneven, with southern Africa—the region hardest hit in 2009—recovering more slowly than the rest of the continent. The report by the African Development Bank, the Organization for Economic Co-operation and Development and the United Nations Economic Commission for Africa said East Africa is predicted to lead the way higher, with growth averaging more than 6% in 2010 and 2011.

"The prospect of only a moderate recovery in a number of African countries makes it even more pressing to address the structural problems, which existed even before the global crisis," said Leonce Ndikumana, Director of the Development Research Department at the African Development Bank.

The report's authors say the world financial crisis slashed growth levels on the continent from an average of 6% in 2006 to 2008 to 2.5% in 2009.

"The good news is that the continent has proved resilient to the crisis," said Henri-Bernard Solignac-Lecomte, Head of the Europe, Africa and Middle East Desk at the OECD Development Center in a press release. Mr. Solignac-Lecomte added that the bad news was that the downturn could make it more difficult for countries to meet their targets of reducing poverty.

The study also studied taxation revenue and found large differences in the performance of individual countries, with some collecting only half the expected revenue given living standards and incomes.

The report was published at the start of the annual meetings of the Board of Governors of the African Development Bank Group.

The economic benefits of hosting a large scale international festival like a World Cup is paying off for South Africa.

South Africa's economy grew at its fastest pace in more than 1 1/2 years as exports grew amid strengthened global demand and the country geared up to host the soccer World Cup, government data for the first quarter showed Tuesday.

The economy should continue to benefit from the World Cup and a slow recovery in domestic consumer spending following last year's recession.

This comes after news showing that African economies have passed the "stress test".

African economies have shown resilience in the face of global financial adversities, have passed the stress test and can be expected to achieve economic growth this year, says Donald Kaberuka, president of the African Development Bank (AfDB).

Addressing African finance ministers April 26 in Washington, Kaberuka acknowledged that the global financial crisis has done some damage, but said African economies are expected to average 5 percent economic growth in 2010 and 6 percent growth in 2011, with some countries forecast to achieve an even higher rate.

In many African countries, he said, the crisis has “only been a setback.”

The entire continent has been subjected to a “stress test and has passed,” he told the ministers, diplomats and finance experts, many of whom were in Washington for World Bank and International Monetary Fund meetings.

For sub-Saharan Africa, Kaberuka said, capital inflows to the region swelled from $10 billion in 2001 to $53 billion just before the economic crisis in 2007. He acknowledged however, that much of the inflow has been concentrated in a few countries and dependent on factors such as the size of the market, the level of political stability, the depth of financial markets and the availability of natural resources.

The AfDB president said while the region’s four largest countries accounted for about 88 percent of those capital inflows, there was a “broadening out” of the recipient base just before the crisis.

As conditions improve and investors see more of the changes they like to see — political stability, accountability and economic transparency — Kaberuka predicted, “I think we will see a change.” He added that Africa is changing right now, but acknowledged that many people are not yet seeing it.

As an example, he pointed to Cape Verde, calling it a “miracle” country in Africa. Cape Verde has gone from being very poor to being a middle-income country. It is no longer receiving soft or concessional loans from the AfDB, he said, but is now borrowing money at market rates. Even though it is still in need of foreign aid, investment and tourism, he said, Cape Verde has made great strides through remittances from its expatriate community and by making good choices.

The African Development Bank has worked hard to stimulate development in Africa, he said. Financing activities by the AfDB have increased from a modest $300 million in 2005 to $1.6 billion in 2008 through direct lending and equity participation.

The global financial crisis presented the AfDB with challenges but also the opportunity to innovate, he said, adding that the goal of the AfDB is to make every dollar it puts into the African economy count for five dollars in real terms to help stimulate economic growth and development.

Kaberuka told his audience that he is convinced that “the macroeconomic reforms that took place in Africa in the 1980s — mainly in the areas of public finance and exchange rates — have provided a very firm foundation [on which to build]. Now what we need are reforms in the microeconomic areas and the efficiencies of institutions.”

Questions are often raised about how much more aid can be given to Africa, he said.

“There is another way to look at this problem,” he said, and he identified lack of infrastructure as the biggest hindrance to Africa’s development and a factor “beyond any country or firm” to confront singlehandedly.

He said the explosive growth of telecom markets in Africa has stepped up demand for fiber optics and satellite communication facilities to meet a substantial need. “At the same time,” he added, “growing businesses large and small are hampered by power outages, poorly maintained roads and dilapidated railways.”

Africa — a continent with 1 billion people, 40 percent of whom live in urban areas and are in need of housing, telephones and services of all types — needs infrastructure. And this need for infrastructure is transforming Africa. In response to these needs, he said, 60 percent of AfDB’s financing in Africa goes to infrastructure — roads, rails, water, broadband, etc.

Lat years economic crisis was an opportunity to pass through reform measures and stay on the economic development front tempted to change course that many countries were on. Africa should stay on course, its going in the right direction.

China defends its policies in Africa

In the Wall-Street Journal, China's vice commerce minister pushed back against Western criticism of China's activities in Africa saying that they are "more market-driven"

Economic activity in Africa has surged in recent years, with Beijing becoming an important investor, creditor and donor for many African nations. But with the rise of China's influence upon the continent, concerns persist that Beijing is preying on the continent's resources to feed the Chinese economy, contributing little significant improvement to African livelihoods.

Amid such criticism—and as China asserts that its presence in Africa is increasingly being shaped by nongovernment actors—Beijing has put in place some mechanisms to deal with issues surrounding its investment and trade on the resource-rich continent.

"China's presence in Africa is becoming more and more market driven, the actors operating there are diverse, there are many models, and the areas they are in are broad," said Fu Ziying, the vice commerce minister, in a recent interview. "The Chinese government is more and more aware that as the economic and trade cooperation between China and Africa evolves, there need to be some laws and protections in place."

In a rare discussion about China-Africa ties, Mr. Fu, the senior trade official in charge of China's Africa portfolio, spoke about what he termed the misunderstandings surrounding China's presence in Africa.

In response to questions about some sensitive cases in the past year related to China's moves in Africa, Mr. Fu's comments suggested there were limits to what the government could do, shedding little light on the controversies.

Last year, a Hong Kong-based entity named the China International Fund struck a massive, $7 billion mining and infrastructure deal in Guinea that gave it, through two Singapore-registered entities, sweeping concessions to the mineral riches of the West African nation. Guinea authorities are now investigating the deal.

Company filings and other documents show that some CIF executives have ties to a Chinese state-owned enterprise. Mr. Fu reiterated denials by Chinese government officials that the government has any involvement in CIF.

"This fund is entirely built by individuals, and it has absolutely no government or Chinese state-owned company background in it," Mr. Fu said, adding that the Chinese government took the step to "inform relevant countries" that no such fund is registered in China.

Meanwhile, when asked about the investigation by Namibian authorities into alleged bribery involving Chinese security-equipment provider Nuctech Co., Mr. Fu said the matter was a civil-commercial dispute, arising from commercial competition, and that the Chinese government wouldn't intervene in such cases.

Mr. Fu, who accompanied powerful Politburo member Jia Qinglin to Namibia in March, said that the Nuctech case hadn't come up during the visit. Neither Nuctech nor its parent company has commented on the investigation.

The probe, which emerged late last year, is sensitive because the Communist Party Secretary of Nuctech's parent company is Hu Haifeng, the son of Chinese President Hu Jintao. References to the case disappeared from Chinese news websites soon after the story surfaced.

Mr. Fu also expressed frustration over persistent criticisms against China by Western nations and multilateral development agencies, which have cited Beijing's lack of transparency in its dealings in Africa and that the financing it provides without conditions on better governance or tackling corruption sets back the local economy.

"It's like marriage. The husband and wife are happy. Their happiness quotient is very high. But suddenly you have someone beside you that keeps criticizing the marriage," he said. "If Africa has a criticism about China's investment in Africa, then that is a problem."

China's engagement with Africa has begun to be studied only in the past few years. One recent study by the Centre for Chinese Studies at South Africa's Stellenbosch University and the Rockefeller Foundation listed the development of local worker skills and labor rights as key challenges that may determine whether Africans will benefit from China's presence on the continent in the long run.

The study also recommended more joint ventures be set up between African and Chinese companies to transfer technology and build capacity and an increase in the role of African civil society in project consultations.

This year China-Africa trade will exceed $100 billion, and the growth in bilateral investment is likely to enter its fastest period in the next five years, Mr. Fu said. Last year, trade between China and Africa fell to $91 billion amid the global financial crisis, from $107 billion in 2008, according to Chinese government data.

In 43 African countries, China and the corresponding African nation have set up a joint committee that convenes to discuss economic and trade issues when needed, Mr. Fu said. Such committees often don't meet more than once a year, and Mr. Fu indicated that there are cases that end up outside of that framework. But he claimed that, along with agreements on bilateral trade and investment protection, they offer a way to smooth burgeoning ties between the two developing economies.

Mr. Fu also responded to a question about a case involving investment in the other direction, from Africa into China. South Africa's Sasol Ltd. in December submitted a plan with its Chinese joint venture partner to build a plant that will convert coal to liquid fuel in China. The project, estimated to cost $5 billion to $7 billion, would be among the largest by an African company in China.

However, a document prepared by the local-level economic-planning agency in Ningxia, where the plant will be located, said that the review of Sasol's plan was being delayed to await a rival plan based on Chinese technology. Sasol has said it remains confident in the project.

"This [Sasol's] project hasn't been rejected," Mr. Fu said, adding that at issue is still a broader question of whether it is better to stick to using crude oil or convert coal to oil for China's energy needs.

Mr. Fu himself led a delegation in April to five African countries: the Central African Republic, the Republic of Congo, Gabon, Liberia and Chad.

In Liberia, where China is carrying out a $2.6 billion project to revitalize the iron ore Bong Mines, Mr. Fu said his group convened a roundtable with senior representatives, including ambassadors, from the local embassies, including ones from the U.S. and EU, along with foreign and local media.

Mr. Fu said the roundtable, including another one set up while he was in Gabon, was done to address the misunderstandings of China in Africa.

China's business with Africa.

More discussion on China in Africa.

China in Africa : Friend or foe for the European Union?

More detailed discussion if China is a constructive partner for Africa or new colonist.

China accused of neo-colonialism taking Africa's resource away.

China eyes Africa's resources

[caption id="" align="aligncenter" width="470" caption="Mamadou Tandja, Niger president (left), who was welcomed in Beijing by Hu Jintao, Chinese president, at the Forum on China-Africa Cooperation which gathered representatives of 48 African countries in November 2006, became the first African leader whose downfall could be traced directly to his embrace of Chinese suitors."] [/caption]

[/caption]

Here is a detailed look how Africa is viewed through the eyes of Beijing:

With China's increased presence and quick business deals, this has brought alot of criticism towards Beijing.

The loser in this particular thrust? France's Areva, which enjoyed a 40-year monopoly on Niger uranium. Given the level of development in Niger, I would say that competition wouldn't be a bad step.

Conclusion: China doesn't take a missionary approach to world affairs, seeking to spread an ideology or a system of government. Moral progress in international affairs is an American goal, not a Chinese one; China's actions abroad are propelled by its need to secure energy, metals and strategic materials in order to support the rising living standards of its immense population, which amounts to about one-fifth of the worlds population.

[/caption]

[/caption]Here is a detailed look how Africa is viewed through the eyes of Beijing:

T he lions of Niamey are going up in the world. The cramped cats may not know it, but when they move to their spacious new enclosure at the zoo in the capital of landlocked Niger, they will be the latest beneficiaries of a latter-day scramble for Africa.

Their $60,000 (£42,000, €49,000) pen is the merest nicety compared with the rest of the largesse that Beijing and companies acting on its behalf are lavishing on an arid west African nation of 15m people more accustomed to hunger and penury.

Following the same bargain it has struck across the continent – swapping infrastructure and cash for resources to sustain its breakneck growth – China has secured access not only to another source of African oil but also to what is perhaps the single commodity considered more sensitive than crude: uranium. It has also turned Niger into a bellwether for those who fear that the struggle to secure the continent’s resources risks re-creating the ruinous brinkmanship of the cold war.

A few mud-red blocks from the zoo, two colonial thoroughfares converge. One, Avenue du Général de Gaulle, is named for the French leader who ensured his country’s stamp remained on its African colonies long after independence. The other, Avenue de l’Uranium, bears the name of the metal that has made Niger the bedrock of France’s nuclear-powered economy.

China has vied with western groups in Africa for oil and minerals for the best part of a decade. But it also has ambitious nuclear power targets and its quest for uranium – repositories of which are few and far between – has thrown the rivalry into sharper focus.

In the past three years, as China embarked on its new thrust into Africa, relations between Niamey and Paris plunged. The award of uranium concessions to China’s Sino-U and other prospectors broke the de facto 40-year monopoly of Areva, France’s state-controlled nuclear group.

The yellowcake trail

In January 2003 George W. Bush, US president, sought to further the case for war by claiming Saddam Hussein had tried to buy material for a nuclear weapon in Africa. The report on which the claim was based – documenting Iraqi attempts to secure yellowcake, semi-processed uranium ore, from Niger – had one flaw. It was fabricated. As coalition forces failed to find yellowcake in Iraq, the affair rumbled on. Lewis “Scooter” Libby, an aide to vice-president Dick Cheney, was convicted of perjury in 2007, following a probe into the outing of a CIA operative whose husband had worked to debunk the claim.

The competition has seen work start on Niger’s first refinery and a $700m hydroelectric barrage, not to mention hundreds of millions of dollars in “signature bonuses”, courtesy of Beijing. It helped the country wring tougher terms from France before granting permission for Areva’s vast new mine, which will make the country the world’s second-biggest uranium producer after Kazakhstan.

Yet a February coup d’etat heightened the anxiety of those who see danger in a stand-off. Although ethnic rivalries and opportunism played their part in the putsch, Mamadou Tandja became the first African leader whose downfall could be traced directly to his embrace of Chinese suitors. “It was because Tandja had Chinese money that he felt he could mock the European Union, Ecowas [the regional bloc], the US,” says Mohamed Bazoum, a former minister who now serves on the “consultative council” created by the military junta that seized power.

The volatility in Niger is worrying to western intelligence agencies as they contemplate al-Qaeda’s presence in the effectively borderless lands of the Sahara. Drugs, weapons and counterfeit goods flow freely. That uranium destined for a dirty bomb could do the same ranks among the west’s security nightmares. Niger’s uranium could also prove of strategic importance as Europe frets about its dependence on Russian gas and looks to nuclear energy to help combat climate change.

With China's increased presence and quick business deals, this has brought alot of criticism towards Beijing.

Rights groups denounce Beijing for its readiness to do business with authoritarians in Sudan or Angola provided the oil keeps flowing. Yet they note that relationships such as Washington’s cosy ties to Equatorial Guinea’s petro-dictatorship deprive the west of any moral high ground.

Even Mr Tandja’s critics would not liken him to a Mobutu or a Mengistu. But that is partly because he failed to cling to power. “He became arrogant,” says one western diplomat. “He counted too much on the Chinese to be there.”

Perhaps Mr Tandja had not acquainted himself with China’s policy of non-interference in the domestic affairs of African states. When young officers stormed the presidential palace on February 18, Beijing was as silent as it had been while he amassed power. The toppled president remains under lock and key. The junta pledged elections by February and has barred its own members from contesting them – so those overseeing the transition are not themselves participants. The soldiers have signalled they have no plans to break with China, although they intend to audit all Tandja-era mining permits.

If Mr Tandja set too much store by his Chinese allies, perhaps Beijing also invested too much in him – and his family. One son, Ousmane, was Niger’s commercial attaché in China. According to people familiar with the matter, he has close links to Trendfield Holdings, a British Virgin Islands-registered consultancy that helped China secure its uranium permits and is funding the lion enclosure at Niamey zoo. (El-Moctar Ichah, head of Trendfield’s Niger subsidiary, dismisses such claims as “speculation”.)

France’s critics say its subdued criticism of both Mr Tandja’s authoritarianism and the coup undermined democratic forces in Niger. “There is a sense of neo-colonialism – that France has no friends, only interests,” says one French expatriate.

Those interests may remain secure. “Fundamentally, Areva is still the big partner,” says another western diplomat. Olivier Muller, Areva’s managing director in Niger, dismisses talk of damaging rivalry with China. “It’s like in oil: there are enough blocks to produce,” he says. “You might compete for the blocks you want but after [they are assigned] you co-operate. In the next 10 years ... all the so-called ‘competitors’ will share infrastructure.”

Areva’s €1.2bn ($1.5bn, £870m) Imouraren mine is on track to start production in 2013. It is slated to yield 5,000 tonnes of uranium a year, doubling Areva’s output in the country. Mr Muller says the negotiations with Mr Tandja were tough but that Areva’s agreement to increase payments to the government by 50 per cent had more to do with rising global prices than competition. He describes Salou Djibo, the previously unknown officer and former United Nations peacekeeper now heading the junta, as “a nice guy”, adding: “I met the president for an hour this morning ... If you have one hour with the president, it has gone well. If not, you get five minutes. Obviously, we don’t talk politics, just business.”

Xia Huang, China’s ambassador in Niamey, says Beijing’s bonds to Niger are unshaken and that grander projects are in the offing, including pipelines and coal-fired power stations. China, he says, has offered Africa a “more profitable option” than other partners have. With a little overstatement, he adds: “This country has already seen uranium extraction for nearly 40 years. But when one sees that the direct revenues from uranium are more or less equivalent to those derived from the export of onions each year, there’s a problem.”

Beijing’s critics are unbowed. Mr Idrissa, the transparency campaigner, repeats charges heard across the continent. Chinese companies prefer to import their own labour and, when they do employ locals, they do so in poor conditions and at low wages, he says. “They are going to take our riches and go,” Mr Idrissa concludes.

But for others, China’s efforts offer an opportunity for industrialisation on a scale never countenanced by the colonisers of old. Ibrahim Iddi Ango, an industrialist and president of the chamber of commerce, is pushing for regulations that would oblige foreign investors to foster the local private sector. He notes that France’s Total and others including ExxonMobil of the US sat on the Agadem block for years but balked at Niamey’s demands. “Each time the government said, ‘build a refinery’, they said: ‘it’s impossible’. The Chinese came and said: ‘A refinery? What size?’”

The loser in this particular thrust? France's Areva, which enjoyed a 40-year monopoly on Niger uranium. Given the level of development in Niger, I would say that competition wouldn't be a bad step.

Conclusion: China doesn't take a missionary approach to world affairs, seeking to spread an ideology or a system of government. Moral progress in international affairs is an American goal, not a Chinese one; China's actions abroad are propelled by its need to secure energy, metals and strategic materials in order to support the rising living standards of its immense population, which amounts to about one-fifth of the worlds population.

Subscribe to:

Posts (Atom)